Speculating on market trends is over. It's time to trade with an edge.

Join our 4-week Live Trading School and transform the way you see the markets.

Learn the SPY75 trading strategy, master our proprietary software, and start making trades with real confidence — fast.

In just 4 weeks you will:

- Master the SPY75 method with 4 high-probability SPY (or ES) setups.

- Place your first SPY75 trades within 2 weeks — no wasted time.

- Get 120+ hours of live, intense instruction.

- Access to previous recordings for additional education.

- Access our private school chat for direct support.

- Train 100% online, at your pace, with real-time sessions.

Chatroom full of experienced traders of SPY, QQQ, stocks, and futures: ES NQ RTY YM

Chatroom full of experienced traders of SPY, QQQ, stocks, and futures: ES NQ RTY YM

Chatroom full of experienced traders of SPY, QQQ, stocks, and futures: ES NQ RTY YM

Chatroom full of experienced traders of SPY, QQQ, stocks, and futures: ES NQ RTY YM

Chatroom full of experienced traders of SPY, QQQ, stocks, and futures: ES NQ RTY YM

Chatroom full of experienced traders of SPY, QQQ, stocks, and futures: ES NQ RTY YM

HFTAlert Software

Our software is unique because it cuts through the noise — it operates independently of price data: no moving averages, no trend channels, no candlestick formations.

The Delineator and Accumulator are very powerful analytical tools that can support dozens of trading strategies.

We will teach you how to trade intraday ranges, going home FLAT every day. You can use SPY, ES, options, or ETFs that replicate the S&P. Once you learn the process, you can become self-reliant.

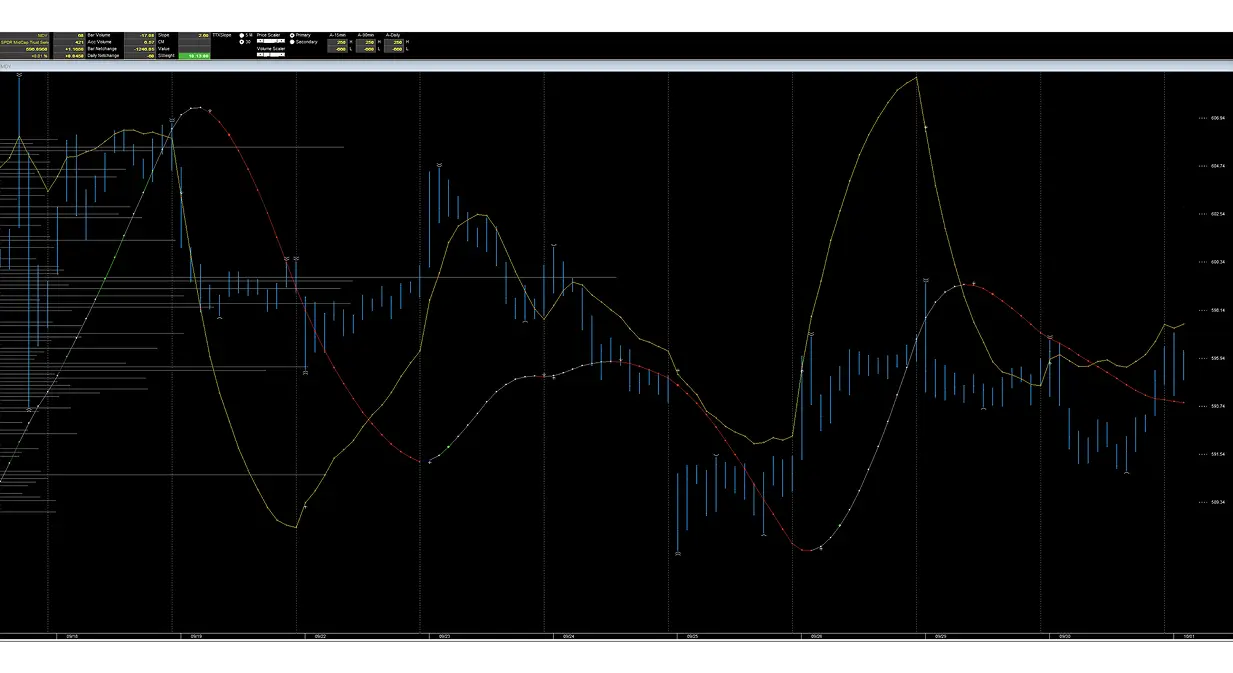

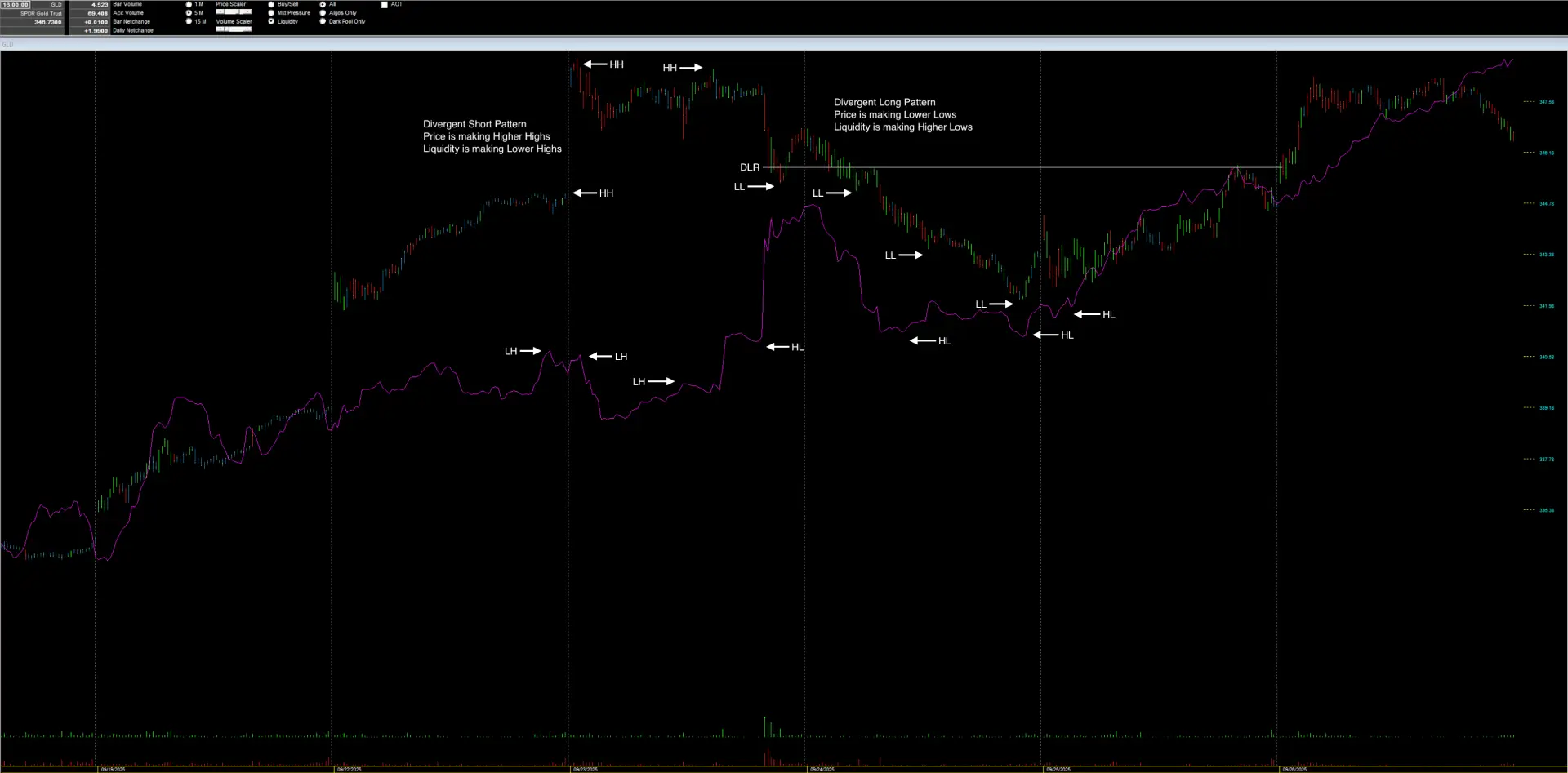

The Delineator

Trade smarter with the Delineator

Trade smarter with the Delineator.

Spot setups, estimate profits, and manage trades across SPY (ES), NASDAQ (NQ), and RUSSELL 2000 (RTY) — all without relying on price alone.

The Delineator is our trend model. It is LEADING and NON-PRICED based and indicates WHEN AND IN WHAT DIRECTION to seek intraday range setups. It estimates the potential DURATION and PROFIT TARGET for each setup. Our system generates consistent, measurable, and repeatable trades with precise targets. The Delineator works for SPY, NASDAQ, Magnificent 7, Russell 2000, and MDY.

Once you learn this, you can use the method for swing trades and/or manage your portfolio of equities.

- Divergences between price and liquidity- long and short.

- Extensions at highs and lows (reversal setups)

- Directional shifts in trading behavior

Leading Non-Priced based Indicator

Indicates when and in which direction to trade.

Provides you with a framework for viewing and anticipating price behavior.

Allows you to identify in advance the direction, magnitude, and duration potential of each cycle.

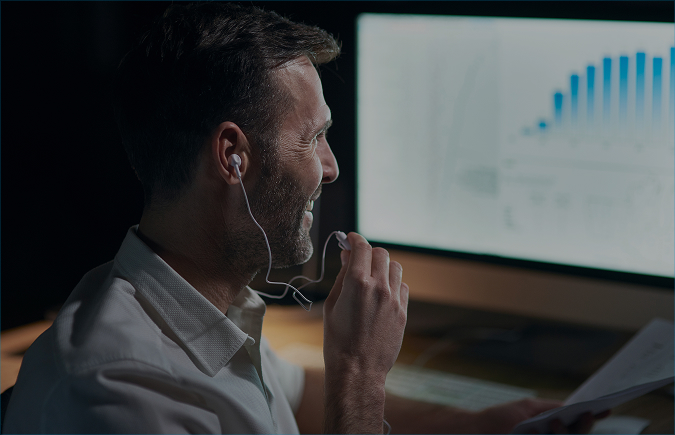

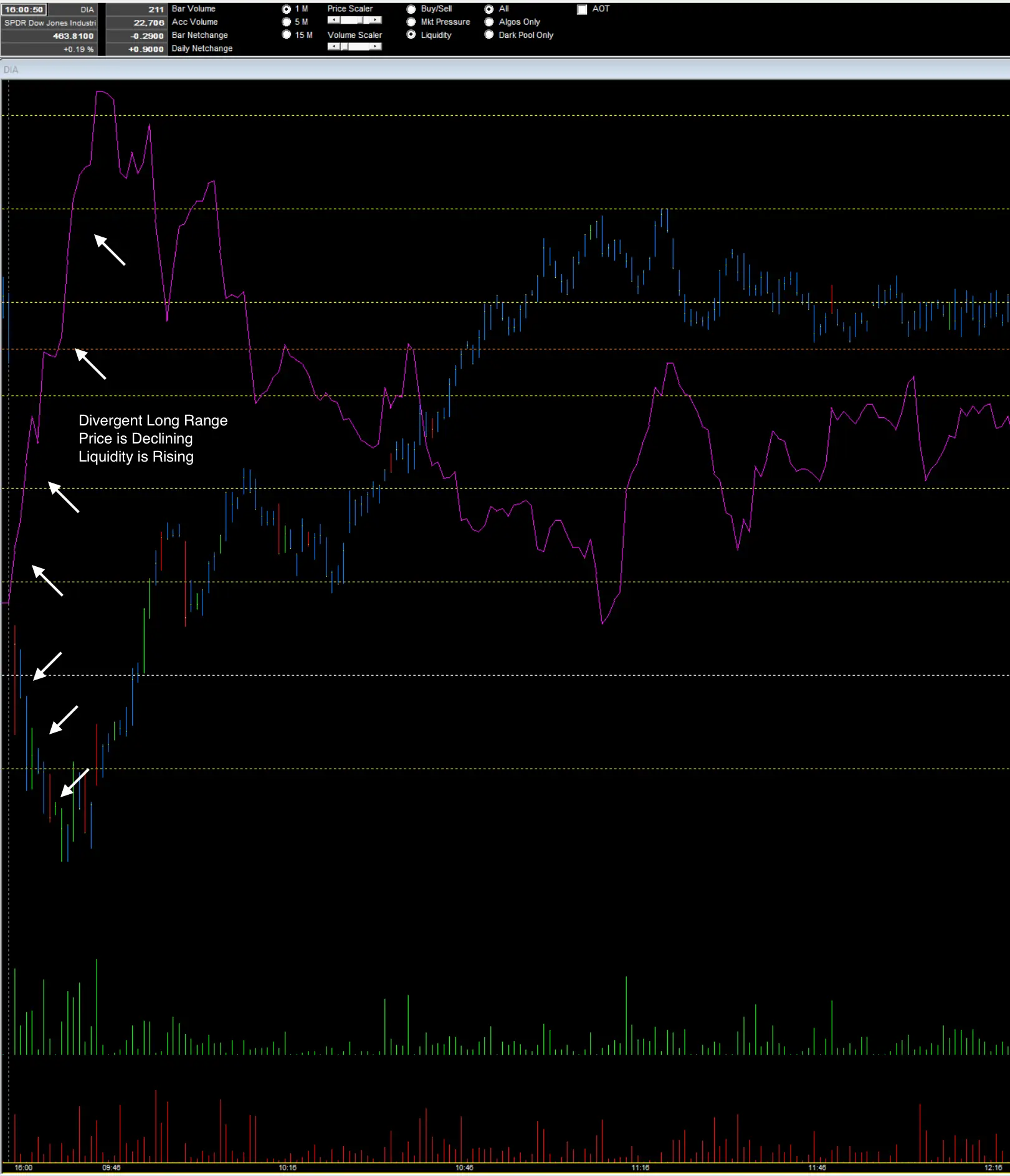

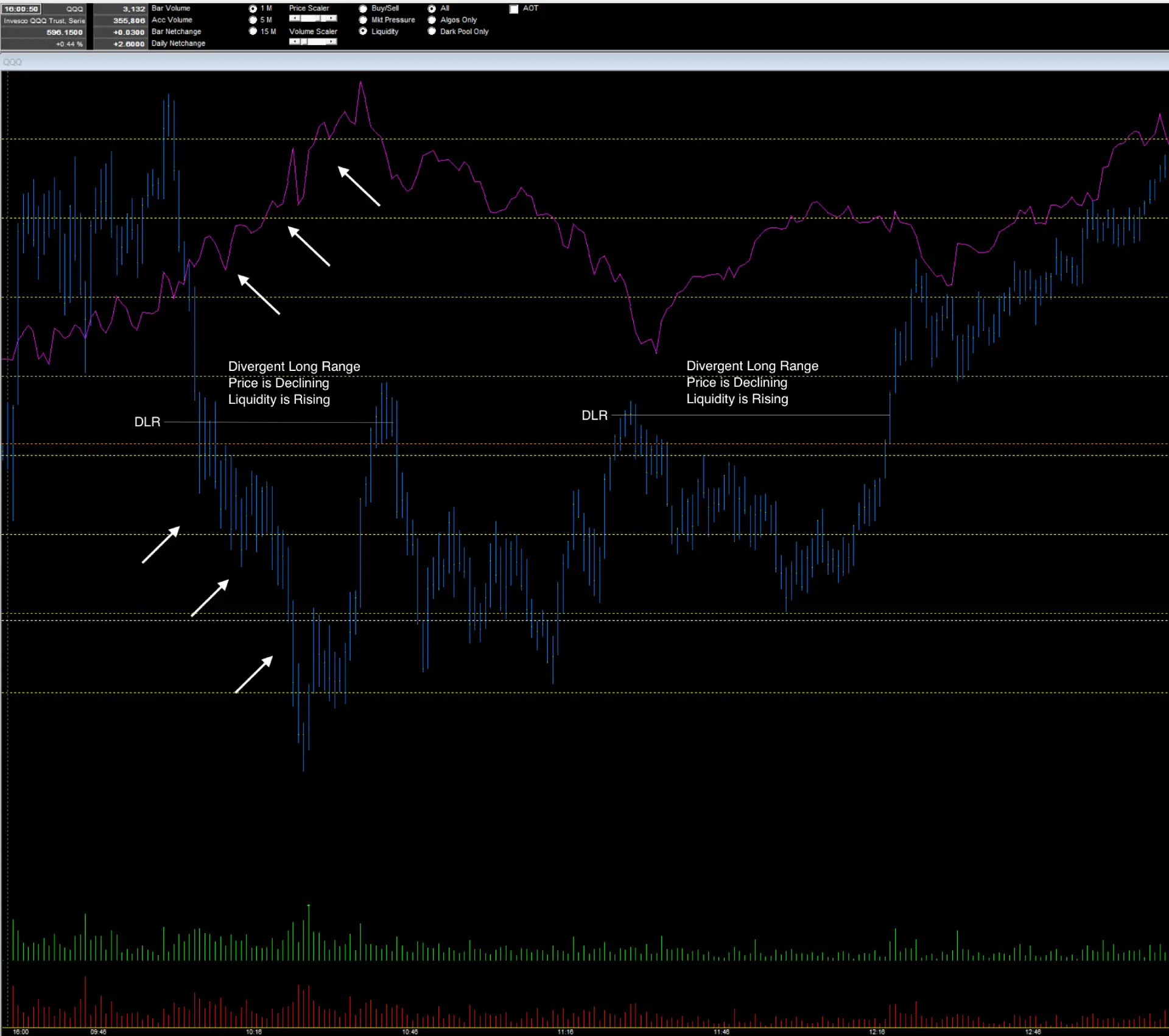

The Liquidity Accumulator

Master the Range

Accumulators work hand-in-hand with the Delineator, supporting the trades it identifies.

In a balanced market, price and the Accumulator move together. But when they diverge, it signals a potential reversal—a shift in control between buyers and sellers. THESE DIVERGENCES ARE YOUR EDGE.

The Accumulator identifies three critical types of activity:

- Divergences between price and liquidity- long and short.

- Extensions at highs and lows (reversal setups)

- Directional shifts in trading behavior

Accumulators are calculated in real time across over 9,000 stocks, each one revealing how an asset is being traded between two points in time.

We use the Accumulator for trading intraday ranges with 1-minute bars. You also get 5-minute and 15-minute time frames, which are especially useful for swing trading.

Detects Divergent Ranges

and Extensions at Highs / Lows

Market Pressure Accumulator Measures Changes in Demand

Buy / Sell Accumulator

Detects Institutional Block Trades

Algos and Dark Pools Accumulator Filter What’s Driving Price Action

Real-Time Sound Alerts:

– Monitor Large Buy / Sell Trades

– Set Triggers by Size and Behavior

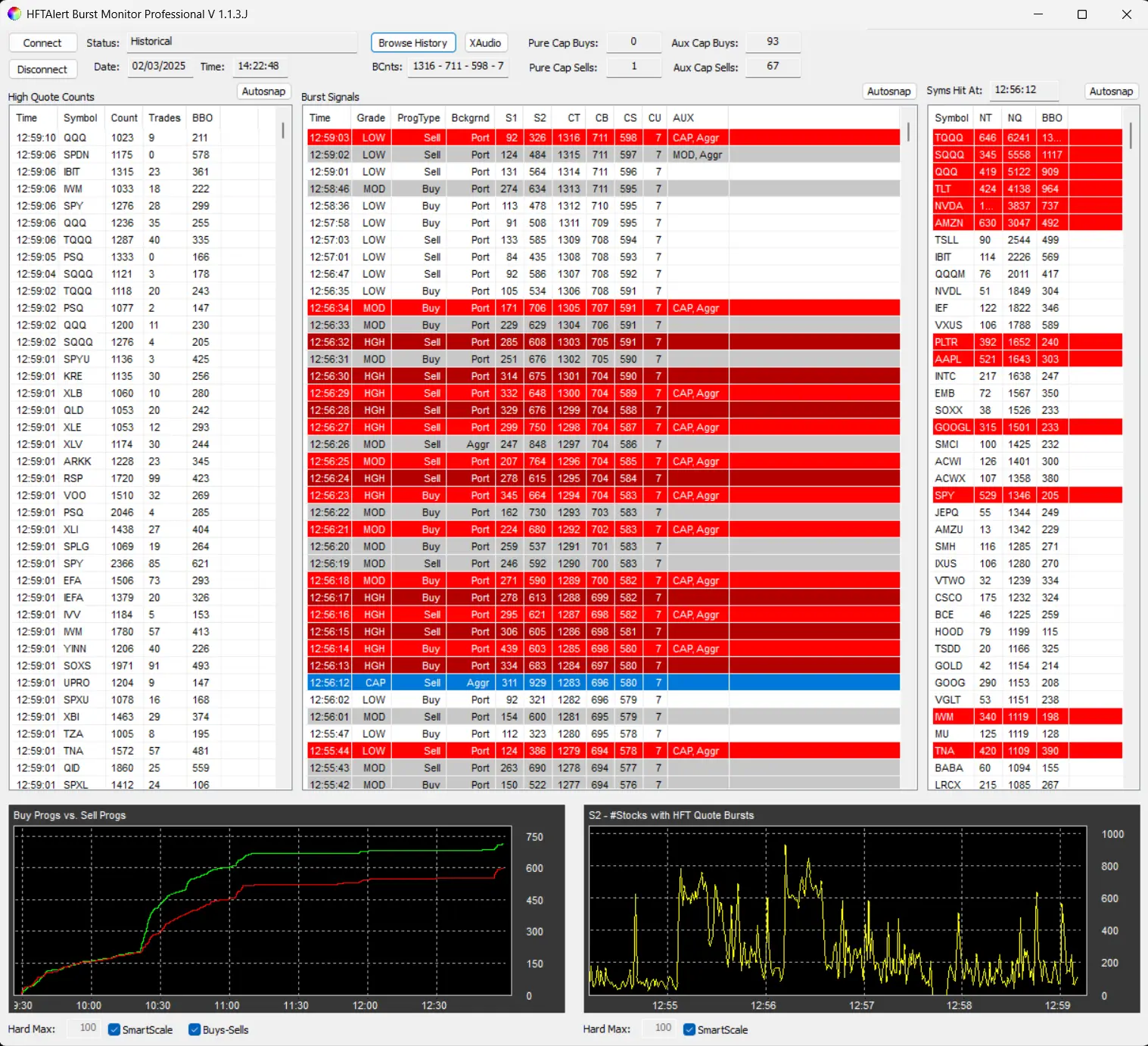

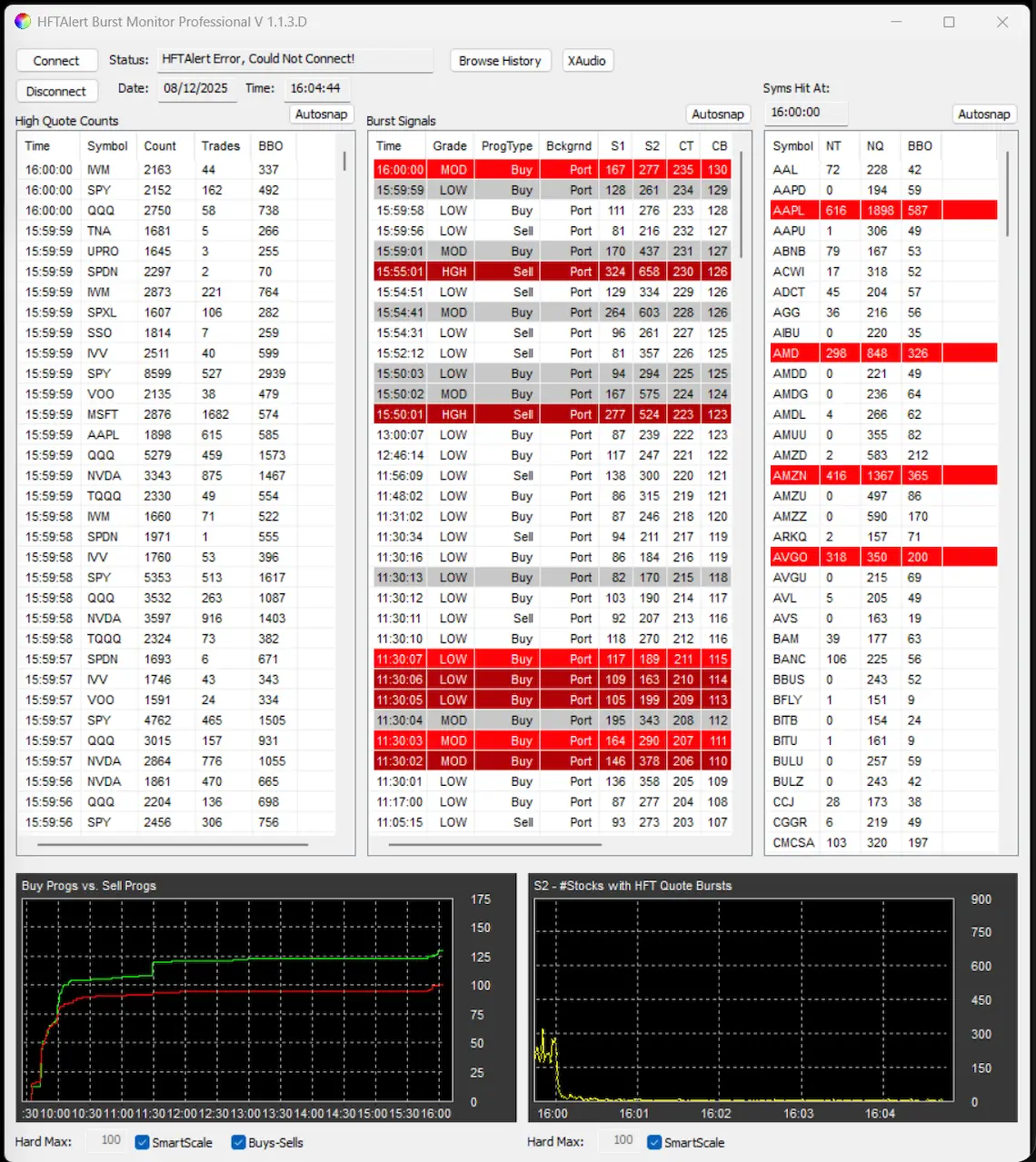

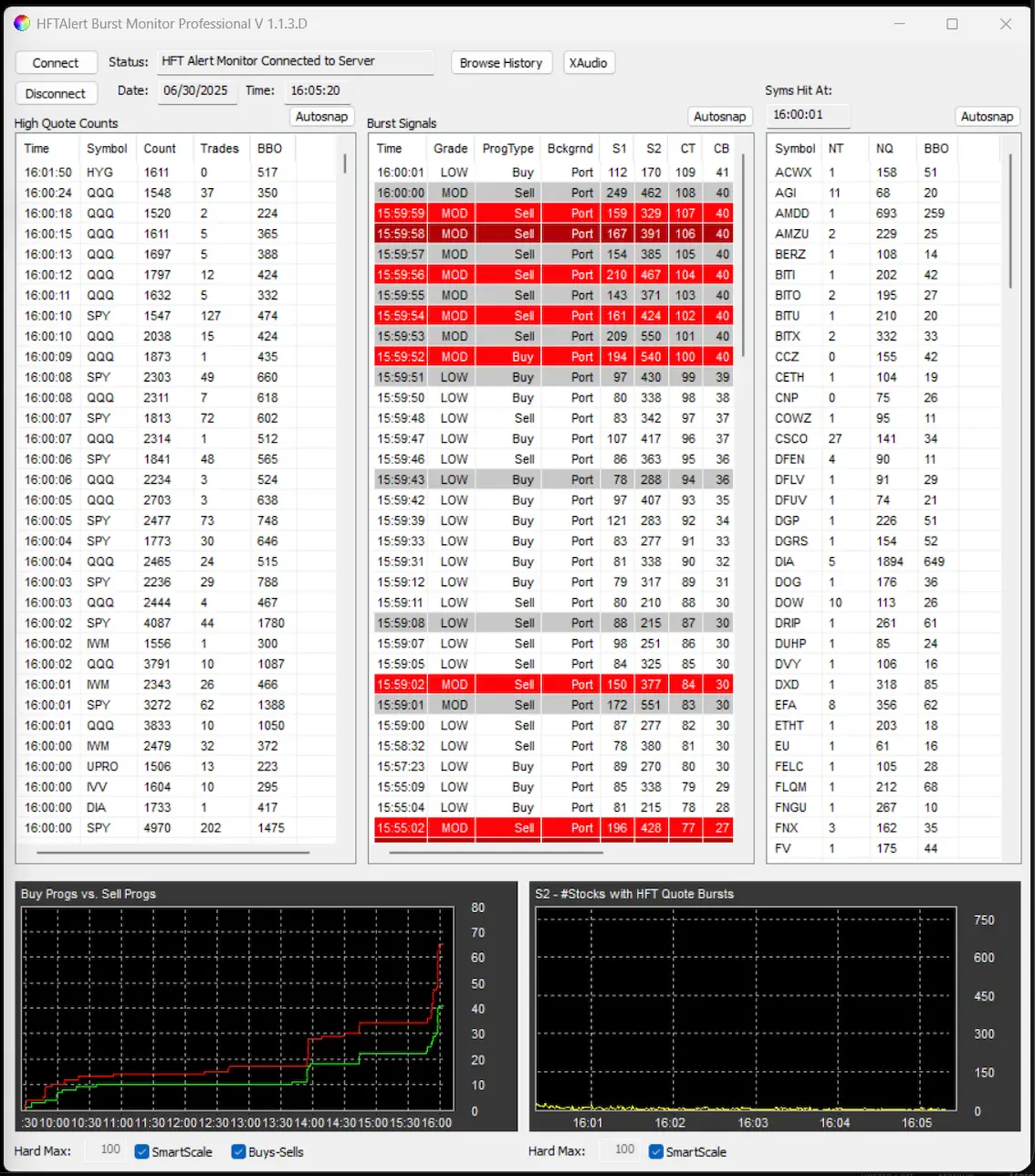

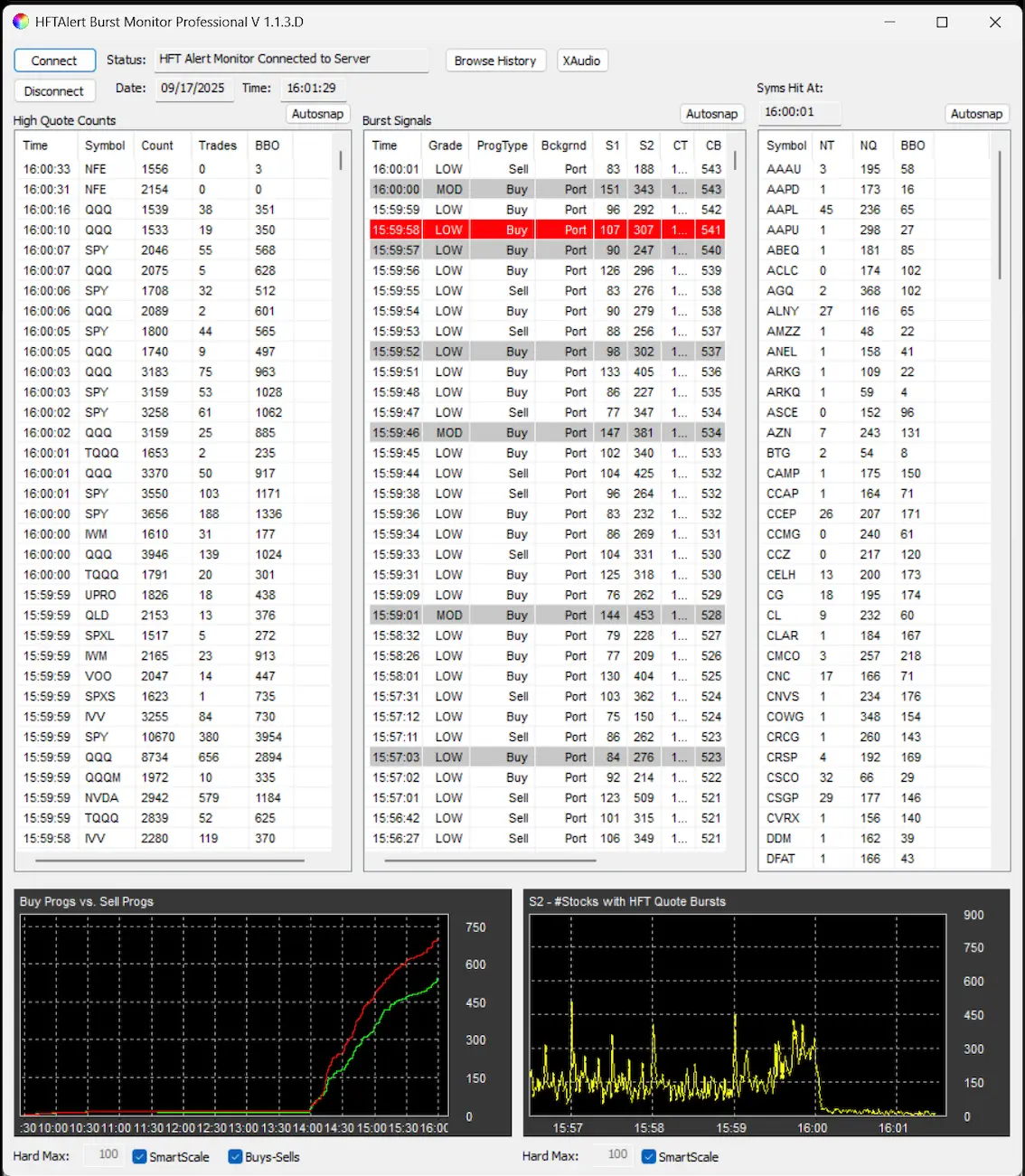

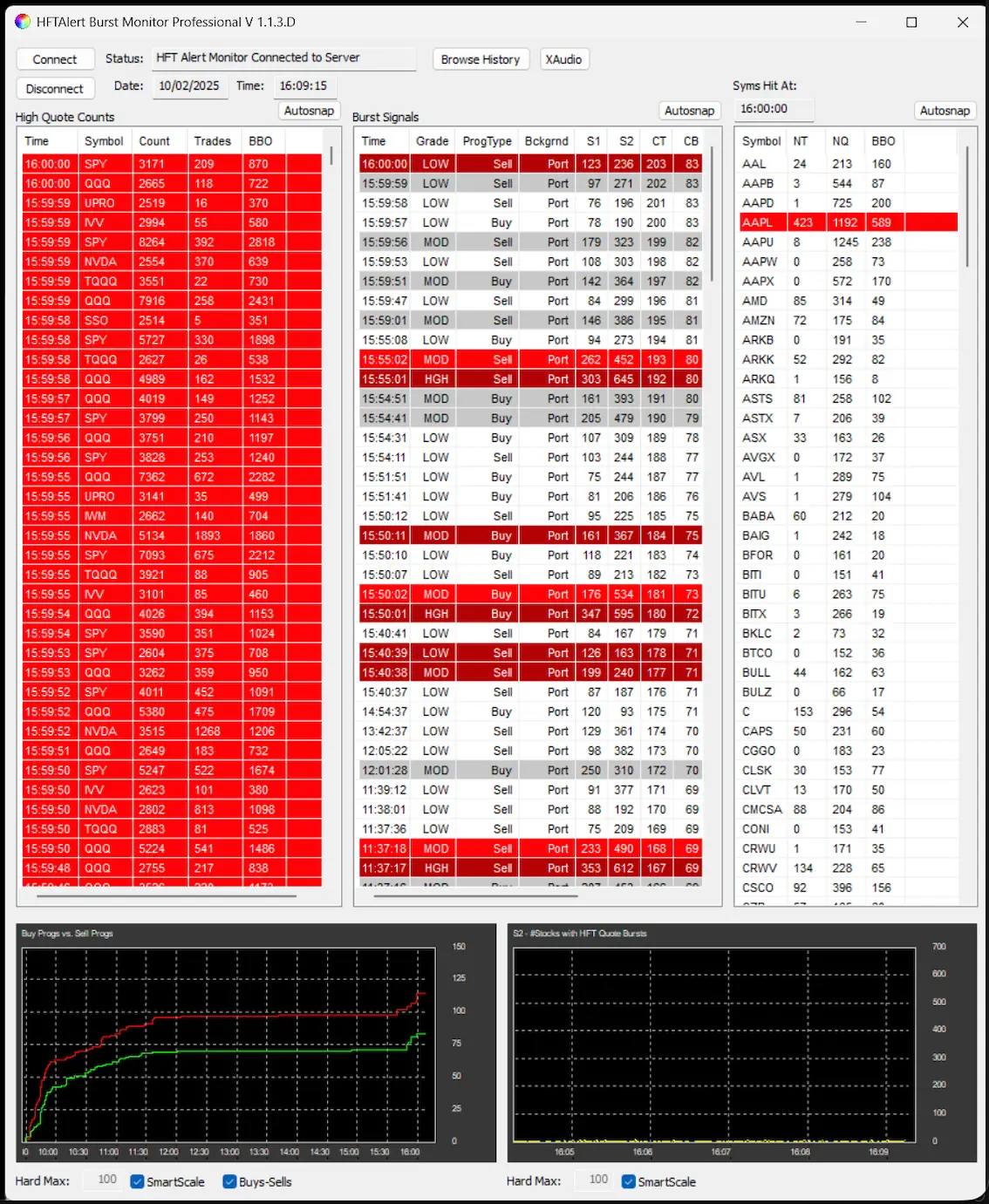

The Burst Monitor

The Burst Monitor – Track the Algorithms. Time the Reversals.

The Burst Monitor from HFTAlert detects high-frequency and automated portfolio trading activity in real time, and displays the information in tabular and graphic formats.

Stocks that have larger quotation activity are highlighted as well as lists of issues targeted by the large HFT and portfolio ‘program bursts’.

Cappers are the biggest program bursts — often signal the end of an intraday range. These events typically mark price exhaustion, often preceding a sharp reversal.

Catching a Capper in real time helps you avoid chasing the tail of a move—and start positioning ahead of the turn.

Tracks high-frequency and automated portfolio trading activity in real-time.

Detects Quote Stuffing

Identifies Large Program Bursts

Targeting Specific Stocks or ETFs

Capper Programs –

Confirm Reversal Points

Buy / Sell Program Totals

Track Who’s in Control

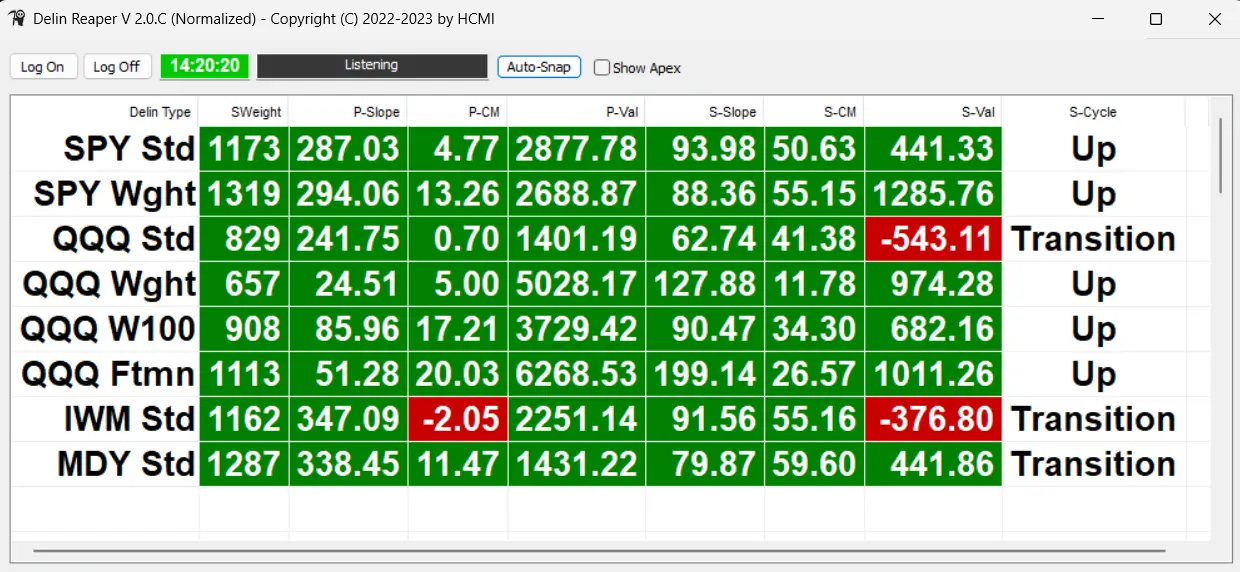

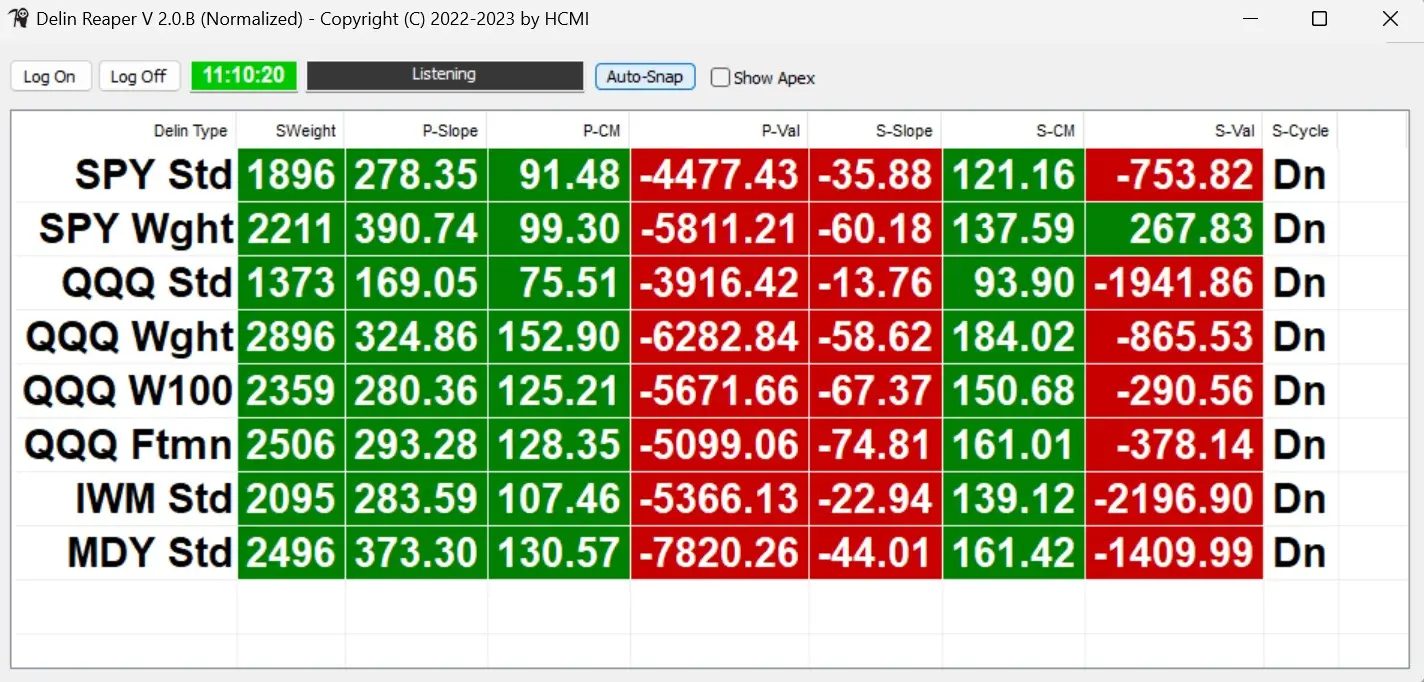

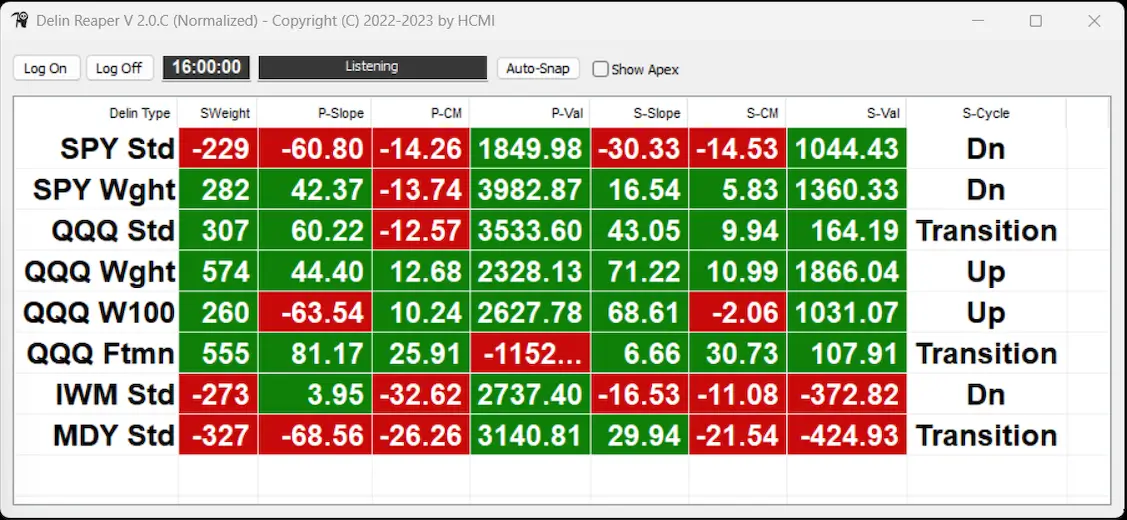

The Delineator Reaper

Signal Weight shows how money flows between indexes and how those moves influence market direction.

The Delin Reaper is our advanced market scanner that visualizes Signal Weight in a normalized format across all four major indexes—SPY, QQQ, IWM, and MDY—along with our proprietary FTMN. This allows for direct comparison of Signal Weight across instruments with very different structures.

With The Reaper you are no longer guessing which index is driving the day. You see it in real time—across standard and market-cap weighted readings.

When the Wght version is stronger than Std, expect price to push toward parity. When weaker, price typically lags or diverges. In QQQ, watch the AltSWs (QQQ Wght & Ftmn)—these lead intrabar rotations.

- SPY Std – our baseline for SPY Signal Weight

- SPY Wght – cap-weighted SPY; compare this to Std for directional cues

- QQQ W100 – cap-weighted QQQ

- QQQ Ftmn – our FATMAAN (MegaCap) composite

How to Use It

Like all signal-based tools, The Reaper rewards time on screen. You’ll begin to recognize:

- When signal weight relationships lead price

- When parity is likely—or unlikely

- How intraday divergences shift real-time price behavior

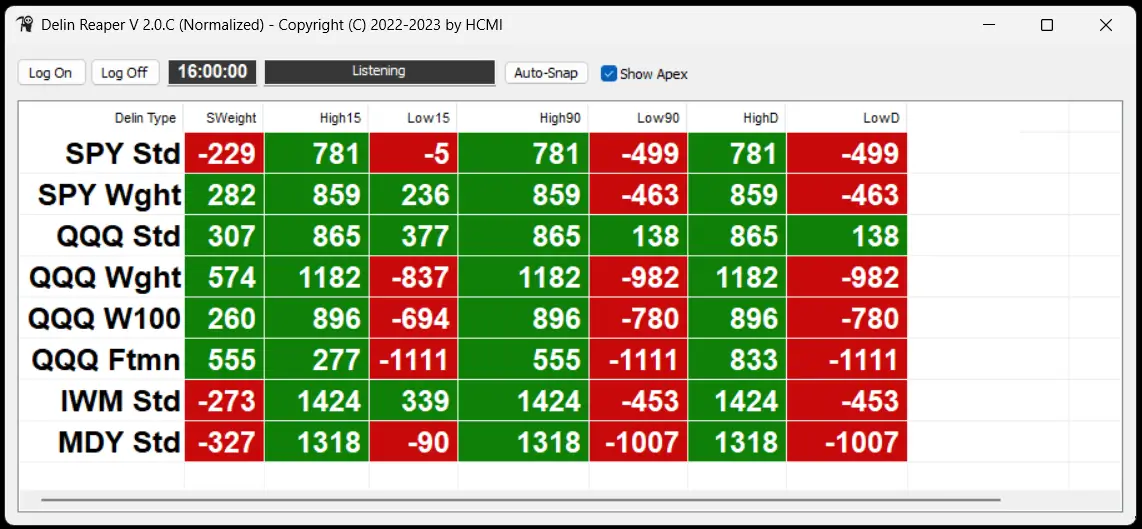

All of this is presented with the Apex Function, giving you three time-frame SW overlays so you’re never blind to the shift—whether it’s trend acceleration, convergence, and potential pivots.

Platform Note:

Designed for Windows. Mac users can run it using a Windows emulator like Parallels.

Proprietary QQQ Ftmn Index

QQQ Wght & Ftmn lead intrabar rotations

Recognize When Signal Weight Lead Price

When Price to Parity is Possible

Apex Function shows Signal Weights Across 3 Time Frames

Designed for Windows.

Run on Mac with Parallels.

Results

The Delineator and Accumulator are powerful analytical tools designed to set up short-term intraday range trades, detect high-probability price reversals, and maximize potential profits. All our setups are MEASURABLE and REPEATABLE. Our very disciplined approach has never had a negative year.

Here are our results in SPY dollar points:

- 2024 results +186 | 2023 results +232 | 2022 results +263 | 2021 results +196 |

- 2020 results +280 | 2019 results +100 | 2018 results +81 | 2017 results +57 |

In our live sessions, you’ll learn how to:

- Find opportunities and Trade intraday ranges with precision — and finish every day flat (no overnight risk).

- Use the tools across SPY, ES futures, options, and S&P-replicating ETFs, as well as 9,000 stocks.

- Master a repeatable process that makes you self-reliant.

- Once you understand the workflow, these tools will help you spot opportunities, manage risk, and trade with complete confidence.

| Results | |||||

|---|---|---|---|---|---|

| Date | Trade type | Result | Year net | Comment | Cycle swing trades |

| 01/01/2024 | TTrb short, Aggressive | +1.00 | - | Was against positive CM, hence the Aggressive posture. | - |

| 02/01/2024 | DOWN CYCLE ORIGINATED ON THE SECONDARY AT 468.65 TT#4 | - | - | New down cycle with dual divergences. | - |

| 03/01/2024 | TT#2 originating long, Aggressive | +1.00 | - | Primary turned up, plenty of positive CM and the Liquidity was supportive, but SW was well below +800, hence the AGG trade. | No TT#2 swing due to insufficient magnitude. |

| 04/01/2024 | TTrb short, Aggressive | +1.00 | - | Was against positive SW and CM, hence the Aggressive posture. | - |

| 05/01/2024 | TTrb short, Aggressive | +1.00 | - | Was against positive SW and CM, hence the Aggressive posture. | - |

| NET FOR WEEK #1 | +4.00 | +4.00 | |||

Journal & Chatrooms

Most traders rely on price-based indicators, lagging signals, or intuition. The result is inconsistency. By contrast, our system allows you to:

- Use the Delineator and Accumulator to identify when and in what direction to trade.

- Identify intraday tradable ranges.

- Execute with precision – оnce a setup has been defined, execute the trade

- Manage the trade with clear rules for profit-taking and stop placement.

We post important information in real time on the Delineator Journal to coach users to identify and act upon the setups provided by the software. In our ChatRoom, we discuss market activity in real time and answer your questions so that you can learn by doing.

This is a disciplined approach that we teach every software and Delineator Journal user. SPY75 specifically targets ranges on SPY (or ES equivalent) in one of four distinct setups. In less than two weeks, most new users are making their first SPY75 trade and already understand what the software does—and what it does not do.

Our Trading School and live ChatRoom are designed to accelerate the transition from theory to action. Within days, new traders are already practicing SPY75 setups in real time. Within weeks, they develop the confidence to execute trades independently, guided by the same rules we’ve used to navigate every type of market since 1998.

WHEN YOU FOLLOW THIS PROCESS, TRADING BECOMES A BUSINESS—NOT A GAMBLE.

4-Week Live Trading School

One-time Fee: $550

Includes:

- Access to all past recordings

- Full access to Premium Journal and Chat Rooms

| Coach Galin Discord LIVE Stream Access (09:00 AM – 4:00 PM ET) | ||

|---|---|---|

| Service | HFTAlert Members | Purchase separately |

| Coach Galin Private Discord — Live Market Commentary & Streaming | FREE | $99.00 |

| Service | Software Users (bundle) | Purchase separately |

|---|---|---|

| Accumulator & Delineator NON PRO | $495.00 | $295.00 each |

| Premium Journal and Chat Rooms | $125.00 | $225.00 |

| Delineator Reaper | FREE | $285.00 |

| Burst Monitor | $50.00 | $65.00 |

The Reaper is free for Delineator Software users. For Journal and Accumulator software users, the Reaper is available for $125/month. For others, the cost is $285/month. Downgrades to the Journal and Reaper package are priced at $225,

plus $285 for the Reaper.

- Trading School includes past content access for flexible learning.

- Coach Galin Discord now delivers full-day live commentary, streamed software data, and real-time trade insights.

- Subscribing as a Software User unlocks significant savings and exclusive perks, including free Reaper access.

- Save over 40% by bundling versus buying separately.